Ehsaas Interest Free Loan Program

In Pakistan, financial stability and entrepreneurship can seem like distant dreams for many individuals struggling to make ends meet. However, the Ehsaas Interest-Free Loan Program offers a significant opportunity for those seeking to build a brighter future. This initiative, introduced by the Pakistani government, provides financial assistance without any interest, allowing individuals to start or expand their businesses.

In this article, we will explore the ins and outs of the Ehsaas Interest-Free Loan Program, including the latest updates for 2024, the online registration process, eligibility criteria, and how to maximize the program’s potential for business success.

Also Read : Akhuwat Personal Loan Apply 2024

What is the Ehsaas Interest-Free Loan Program?

Launched in 2019, the Ehsaas Interest-Free Loan Program aims to alleviate poverty and promote financial inclusion. It enables individuals from low-income backgrounds to start or grow businesses by providing interest-free loans. The program is part of the larger Ehsaas Program launched by the Government of Pakistan to uplift the financially marginalized segments of society.

Key Features of the Program (H2)

Loan Amount: Up to PKR 75,000

Interest Rate: 0%

Repayment Period: 3 years

Target Group: Individuals with limited income and viable business ideas

Registration Process: Online

Eligibility Criteria: Based on age, domicile, and poverty score

Objectives of the Ehsaas Interest-Free Loan Program (H3)

The primary goals of the program are:

To empower individuals with limited resources to start or expand their businesses.

To promote economic growth and financial inclusion.

To reduce poverty and improve the living standards of vulnerable segments of society.

Also Read : Akhuwat Business Loan Apply 2024

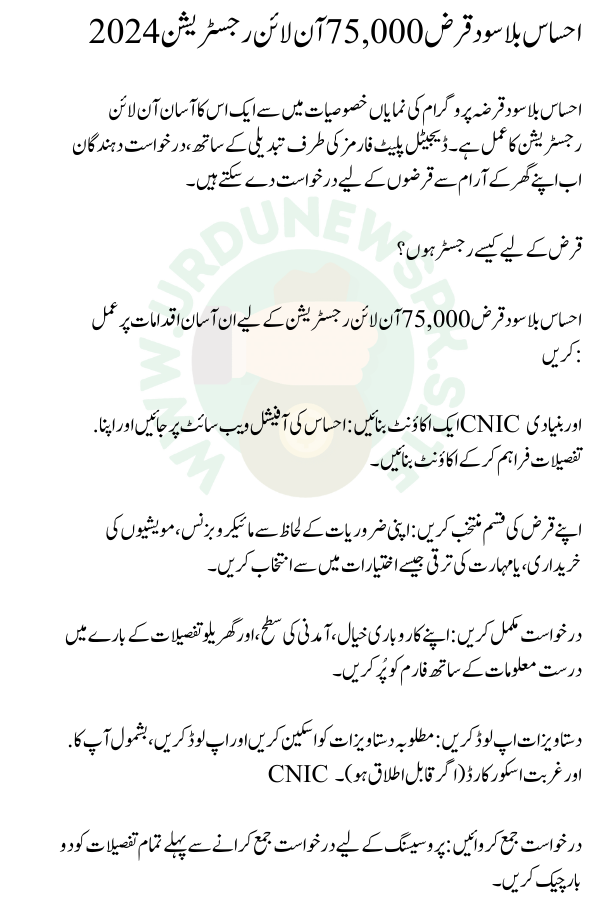

Ehsaas Interest-Free Loan 75,000 Online Registration 2024

One of the standout features of the Ehsaas Interest-Free Loan Program is its easy online registration process. With the shift toward digital platforms, applicants can now apply for loans from the comfort of their homes.

How to Register for the Loan?

Follow these simple steps for the Ehsaas Interest-Free Loan 75,000 Online Registration:

1. Create an Account: Visit the official Ehsaas website and create an account by providing your CNIC and basic details.

2. Select Your Loan Type: Choose from options such as micro-business, livestock purchase, or skill development, depending on your needs.

3. Complete the Application: Fill out the form with accurate information regarding your business idea, income level, and household details.

4. Upload Documents: Scan and upload the required documents, including your CNIC and Poverty Score Card (if applicable).

5. Submit the Application: Double-check all the details before submitting the application for processing.

Also Read : Big News:Ehsaas Interest Free Loan Program

Eligibility Criteria for the Ehsaas Interest-Free Loan Program

To be eligible for the Ehsaas Interest-Free Loan Program, applicants must meet specific criteria. These criteria ensure that the program targets individuals who genuinely need financial assistance.

Basic Eligibility Requirements

Age: Applicants must be between 18 and 45 years old.

Domicile: The applicant must be a Pakistani citizen and domiciled in Pakistan.

Poverty Score: Applicants should have a Poverty Score Card (PSC) score below 40, which indicates a vulnerability to poverty.

Valid CNIC: A valid Computerized National Identity Card (CNIC) is mandatory.

Skill Training or Business Plan: Depending on the loan type, the applicant may need to provide proof of relevant skill training or a well-defined business plan.

The Approval Process for Ehsaas Loan Program 2024

The application approval process for the Ehsaas Interest-Free Loan Online Application: involves several stages of verification and assessment. Understanding these steps will help applicants prepare for the process.

Step-by-Step Approval Process

1. Initial Screening: After submission, your application will be screened to verify basic eligibility and document accuracy.

2. Field Verification: Officials may visit your home to assess your living conditions and the potential of your business idea.

3. Loan Committee Review: A committee will evaluate your financial need and business viability before approving the loan.

4. Notification: You will be notified of the approval or rejection via SMS, email, or post.

What to Expect After Approval?

Securing a loan is just the beginning of your entrepreneurial journey. The Ehsaas Interest-Free Loan Program offers several resources to ensure that applicants succeed in their ventures.

Post-Loan Support and Resources

pre-loan Training: Applicants receive workshops and training on essential business management skills to help them navigate their new ventures effectively.

Financial Literacy Workshops: Borrowers can attend workshops to learn how to manage finances better and navigate the loan repayment process.

Business Monitoring: The program ensures that the loaned money is being used productively through regular checks and business monitoring.

Frequently Asked Questions (FAQs)

For those looking to understand more about the Ehsaas Interest-Free Loan Program, here are some commonly asked questions:

1. Who is eligible for the Ehsaas Interest-Free Loan Program?

To qualify for the loan, you must:

Be aged between 18 and 45 years.

Be a Pakistani citizen domiciled in Pakistan.

Have a Poverty Score Card (PSC) score below 40.

Possess a valid CNIC.

Depending on the loan type, you may need relevant skill training or a defined business plan.

2. What is the maximum loan Ehsaas Interest Free Loan Program amount available?

Loan amounts range from PKR 5,000 to PKR 75,000, based on your business needs and the program’s assessment of your eligibility and business viability.

3. How can I apply for the Ehsaas Interest-Free Loan Ehsaas Interest Free Loan Program?

The entire application process is online:

Visit the official Ehsaas Interest-Free Loan program website.

Create an account, select the loan type, fill out the application, and upload necessary documents.

Submit your application and wait for processing.

4. What documents are required for the Ehsaas Interest Free Loan Program application?

You will need the following documents:

CNIC

Poverty Score Card (if applicable)

Any specific documents related to your business, such as skill training certificates or a business plan.

5. How long does it take to get approval?

The approval process involves initial screening, field verification, and a review by the loan committee. You will be notified of the outcome through SMS, email, or post.

Conclusion

The Ehsaas Interest-Free Loan Program is an incredible opportunity for Pakistanis seeking to break free from the cycle of poverty and build sustainable businesses. With an easy online registration process and comprehensive support, this initiative can empower individuals to achieve financial independence. Whether you’re starting a micro-business or expanding an existing one, the program’s interest-free loans Ehsaas Interest Free Loan Program offer a lifeline to those in need. If you’re eligible, take the step today and apply for the Ehsaas Loan to unlock your entrepreneurial potential.