Ehsaas Loan Program 2024

The Ehsaas Loan Programis an initiative by the Government of Pakistan aimed at reducing poverty by offering interest-free loans to marginalized groups. This program, which started in March 2020 under Prime Minister Imran Khan, has expanded its outreach, providing financial support to students, startups, and unemployed individuals. As we move into 2024, the program continues to grow, offering greater opportunities for those in need of financial assistance. This article serves as a complete guide to the Ehsaas Loan Program 2024, including eligibility, registration, and how you can benefit from it.

Introduction to Ehsaas Loan scheme 2024

Are you a student looking for financial support? Or maybe you are unemployed and struggling to make ends meet. Perhaps you are a woman who wants to become financially independent. Whatever the case, the Ehsaas Loan Program is designed to assist all these groups.

The Ehsaas Loan Program offers interest-free loans to those who meet its eligibility criteria, making it easier for individuals to start small businesses or continue their education without worrying about crippling financial debt. The program, spearheaded by Prime Minister Shehbaz Sharif, operates through more than 1,100 loan centers nationwide and has disbursed funds to over 147 districts in Pakistan.

With loans ranging from Rs. 2,000 to Rs. 500,000, beneficiaries can use the funds to invest in their business ventures, educational needs, or any other financial necessity. Best of all, the loans come with a flexible repayment period of up to 3 years.

Read More: Ehsaas Loan Program Interest Free 2024

Eligibility Criteria for Ehsaas Loan 2024

Before applying for the Ehsaas Loan Program, it’s important to understand whether you qualify. The eligibility criteria ensure that the most deserving individuals receive financial aid. The following groups are eligible:

Individuals earning less than Rs. 40,000 per month.

Specially-abled persons.

Transgender individuals.

Students from marginalized communities.

Aspiring entrepreneurs with startup ideas.

Individuals between the ages of 18-60.

Pakistani citizens holding a valid CNIC (Computerized National Identity Card).

Individuals with a poverty score of 0-40.

Special Provisions for Women

To promote female entrepreneurship and financial independence, 50% of the loan disbursements are reserved for women. This initiative empowers women to take control of their financial future and contribute to the economy.

Read More: Akhuwat Agriculture Loan Apply 2024

How to Register for the Ehsas Loan Program?

Now that you know the eligibility criteria, let’s move on to the registration process. The Government of Pakistan has made it easy for citizens to apply through several methods:

1. Ehsaas Loan App

The easiest way to apply is through the Ehsaas Loan mobile app, available on both Android and iOS platforms. Simply download the app, enter your CNIC, and follow the instructions to complete the application process.

2. Official Website

You can also apply online by visiting the Pakistan Poverty Alleviation Fund (PPAF) website. Fill out the registration form with your personal details, including your CNIC, income, and household information. Once submitted, your application will be reviewed, and you will receive a confirmation within 2-4 weeks

3. Ehsaas Loan Centers

If you prefer an in-person approach, you can visit any of the 1,100 loan centers established across Pakistan. These centers are equipped to guide applicants through the registration process.

4. 8171 Web Portal

The 8171 web portal is another convenient method for registration. All you need to do is enter your 13-digit CNIC number to check your eligibility and submit your application.

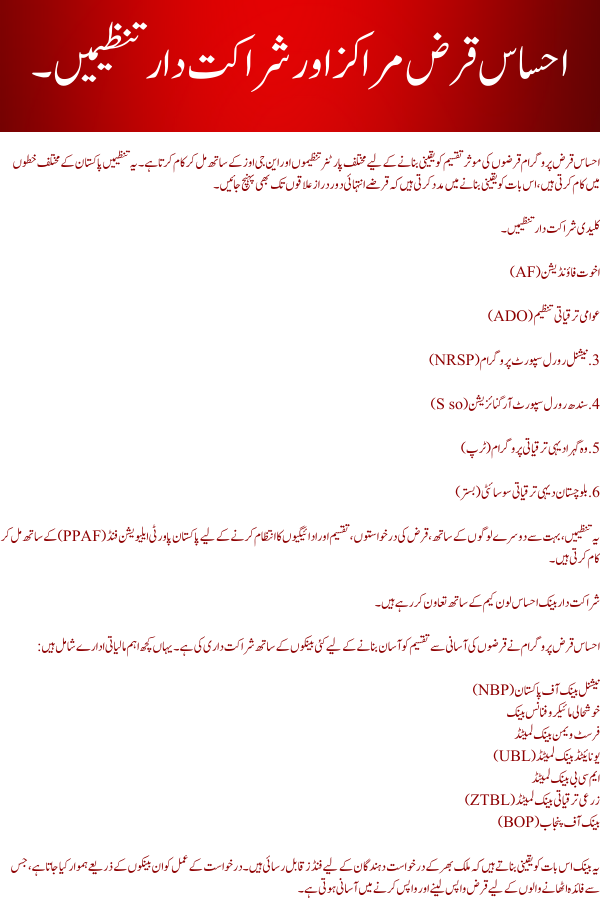

Ehsaas Loan Centers and Partner Organizations

The Ehsaas Loan Program works in collaboration with various partner organizations and NGOs to ensure the effective disbursement of loans. These organizations operate across different regions in Pakistan, helping ensure that loans reach even the most remote areas.

Read More: Akhuwat Health Loan Apply 2024

Key Partner Organizations

1. Akhuwat Foundation (AF)

2. Awami Development Organization (ADO)

3. National Rural Support Program (NRSP)

4. Sindh Rural Support Organization (S so)

5. That deep Rural Development Program (Trip)

6. Balochistan Rural Development Society (Beds)

These organizations, along with many others, work closely with the Pakistan Poverty Alleviation Fund (PPAF) to manage loan applications, disbursements, and repayments.

Partner Banks Collaborating with Ehsaas Loans Scheme

The Ehsaas Loan Program has partnered with several banks to facilitate the easy disbursement of loans. Here are some of the main financial institutions involved:

- National Bank of Pakistan (NBP)

- Khushhali Microfinance Bank

- First Women Bank Limited

- United Bank Limited (UBL)

- MCB Bank Limited

- Zarai Taraqiati Bank Limited (ZTBL)

- The Bank of Punjab (BOP)

These banks ensure that the funds are accessible to applicants across the country. The application process is streamlined through these banks, making it easier for beneficiaries to withdraw and repay the loan.

Read More: Akhuwat Health Loan Apply 2024

| Category | Details |

|---|---|

| Loan Amount | Rs. 2,000 – Rs. 500,000 |

| Eligibility | Monthly income < Rs. 40,000, ages 18-60 |

| Special Provision | 50% of loans reserved for women |

| Application Methods | App, Website, Loan Centers, 8171 Portal |

| Partner Banks | NBP, UBL, MCB, Khushhali Bank, ZTBL |

| Repayment Period | Up to 3 years |

| Approval Time | 2-4 weeks |

Frequently Asked Questions (FAQs)

-

How long does the loan approval process take?

The loan approval process generally takes 2-4 weeks. After you submit your application and all the necessary documents, you will receive a confirmation letter if you meet the criteria.

-

What is the maximum loan amount?

The maximum loan amount available under the Ehsaas Loan Program is Rs. 500,000. This amount is sufficient to start a small business or meet educational expenses.

- How are the loans disbursed?

Loans are disbursed through banks and partner organizations. Once your application is approved, you will receive the funds in your designated bank account.

-

Can women apply for the Ehsaas Loan?

Yes, women are highly encouraged to apply, and 50% of the loans are reserved for female applicants.

-

Conclusion

- The Ehsaas Loan Program 2024 is a lifeline for underprivileged individuals in Pakistan, offering interest-free loans to help break the cycle of poverty. Whether you are a student, entrepreneur, or unemployed citizen, this program can provide the financial support you need. With a straightforward application process and a flexible repayment period, the Ehsaas Loan Registration Program is an excellent opportunity for those looking to improve their financial situation.

-

Read More: Akhuwat Education Loan Apply 2024