How to Get a Salary Loan from Apna Bank

In today’s challenging times, many employees face sudden financial needs, whether for a medical emergency, wedding expenses, education fees, or other urgent payments. For salaried individuals in Pakistan, Apna Bank offers a solution that complies with Islamic laws the Apna Salary Loan This loan is especially designed for employees of both government and private sectors who are looking for a quick, reliable financial solution.

This article provides detailed information on how to apply, eligibility requirements, and frequently asked questions.

Also Read : LOLC Bank Salary Loan for Employees

What is Apna Salary Loan?

The Apna Salary Loan is an option specifically tailored for low-income salaried individuals, aiming to help them bridge financial gaps. The maximum loan amount available is up to Rs. 150,000, which can be used for various needs. This product stands out because it’s Sharia-compliant, meaning it follows Islamic financial principles, making it an ideal choice for many in Pakistan.

Benefits of Choosing Apna Salary Loan

Apna Salary Loan offers several advantages that make it a practical choice for salaried individuals. Here’s what makes this loan option beneficial:

Sharia Compliance: Apna Bank offers a loan product that aligns with Islamic laws, ensuring a fair and interest-free experience.

Accessibility for All Salaried Employees: Employees who receive their salary in cash are also eligible to apply, making this option accessible to a broader range of individuals.

Quick Application Process: With only a few documents required, applicants can easily apply without hassle.

Optional ATM Card: Loan holders have the option to get an ATM card, offering additional flexibility and access to banking services.

Full Range of Banking Services: Alongside the loan, Apna Bank provides comprehensive banking solutions, making it convenient to manage finances in one place.

Also Read : First Women Bank Salary Loan for Government Employees

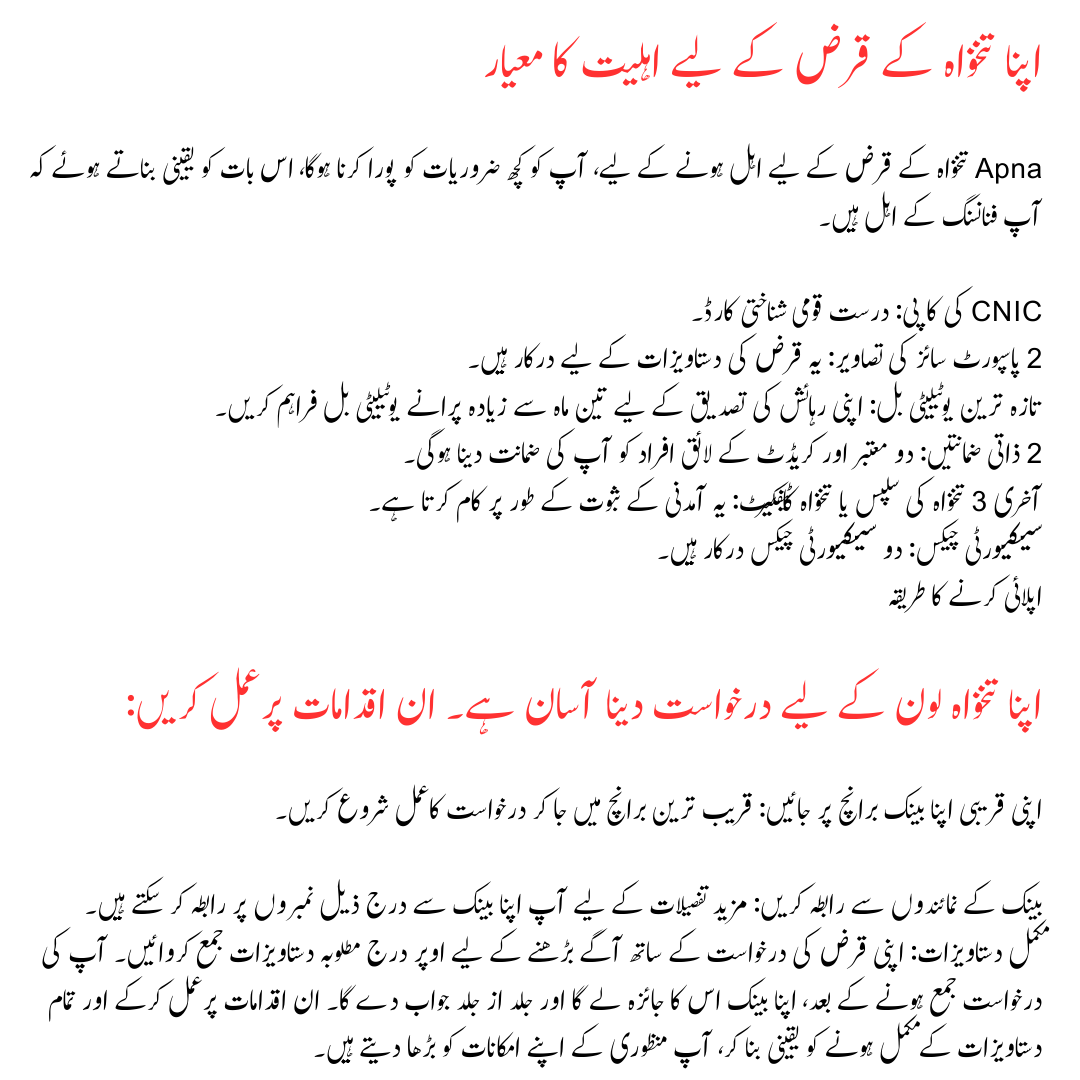

Eligibility Criteria for Apna Salary Loan

To qualify for the Apna Salary Loan, you must meet certain requirements, ensuring you are eligible for the financing.

- Copy of CNIC: Valid national ID card.

- 2 Passport Size Photos: These are required for the loan documentation.

- Latest Utility Bills: Provide utility bills not older than three months to verify your residence.

- 2 Personal Guarantees: Two reputable and credit-worthy persons must vouch for you.

- Last 3 Salary Slips or Salary Certificate: This serves as proof of income.

- Security Cheques: Two security cheques are required.

How to Apply

Applying for the Apna Salary Loan is simple. Follow these steps:

Visit Your Nearest Apna Bank Branch: Start the application process by visiting the nearest branch.

Contact Bank Representatives: For more details, you can contact Apna Bank at the following numbers:

Complete Documentation: Submit the required documents listed above to proceed with your loan application. once your application is submitted, Apna Bank will review it and respond as soon as possible. By following these steps and ensuring all documentation is complete, you increase your chances of approval.

Also Read : Sindh Bank Saadat Sukoon Salary Loan for Govt Employees

FAQs

What is the maximum loan amount for the Apna Salary Loan?

The maximum loan amount is up to Rs. 150,000, which can be used to meet urgent financial needs.

Do I need a bank account with Apna Bank to apply?

Yes, you need to have an account with Apna Bank as the loan amount will be disbursed into your account.

Is this loan Sharia-compliant?

Yes, Apna Salary Loan is designed in accordance with Islamic financial principles.

Can I apply if I receive my salary in cash?

Yes, employees receiving their salary in cash are also eligible to apply.

What documents are needed for the loan application?

Key documents include your CNIC, two passport photos, utility bills, salary slips, personal guarantees, and security cheques.

Is there any collateral required for this loan?

Apna Salary Loan requires two personal guarantees but does not need additional collateral.

How can I reach Apna Bank for more information?

You can contact Apna Bank at +9242-36305314 or +9242-36305315 for more details.

How long does it take to process the loan application?

The processing time depends on the completeness of your documentation. Apna Bank aims to review applications promptly.

Are there any service fees associated with this loan?

Contact Apna Bank directly to confirm any service charges or processing fees applicable.

Is there an age limit to apply for this loan?

Age criteria may apply; consult Apna Bank representatives for specific eligibility guidelines.

Conclusion

Apna Salary Loan offers salaried individuals an accessible and Sharia-compliant solution to address their urgent financial needs. By providing up to Rs. 150,000, Apna Bank ensures employees can handle immediate expenses for health, education, weddings, and more without stress. With minimal documentation, straightforward eligibility, and the convenience of banking services, this loan is an ideal choice for salaried Pakistanis.

For any further questions, please contact Apna Bank directly at +9242-36305314 or +9242-36305315. This contact can assist with detailed information and support throughout your loan application process.