How to Get an Interest-Free MCB Personal Loan | Apply Online

In Pakistan, Interest-Free MCB Personal Loan are becoming increasingly popular for families to meet essential needs, from healthcare to education to home renovations. Among the trusted banks, MCB Bank offers accessible loan options, especially for middle-class individuals seeking financial solutions without the complexities.

In this article, we will discuss the Loan requirements, how to use the Loan calculator, the steps to apply for an Interest-Free MCB Personal Loan online, and insights on MCB personal loan interest rates.

Additionally, we’ll cover MCB’s special Islamic loan product offered by Mcb Bank for those interested in interest-free loans. By the end, you’ll have a clear understanding of how to avail of an MCB loan, calculate your finances, and find the best fit for your needs.

Also Read : How to Apply for a Ubank Salary Loan in Pakistan

MCB Personal Loan Overview

MCB Bank provides accessible personal loans with transparent terms to help individuals manage unexpected expenses. MCB’s personal loan is a quick and easy solution, offering various benefits to ease your financial burden:

- Loan Amount: Minimum PKR 50,000 to a maximum of PKR 2 million.

- Tenure: Flexible repayment period from 1 to 4 years.

- Eligibility: Salaried individuals from both private and public sectors.

- Collateral-Free: No collateral is required to secure the loan.

- Approved Cities: Includes major cities like Karachi, Lahore, Islamabad, and more.

For those looking for Islamic financing, Mcb Bank offers an interest-free loan option, fully compliant with Islamic laws, catering to customers who prefer an alternative to traditional interest-based loans.

Key Features of MCB Personal Loan

MCB Bank offers several attractive features in its personal loan program:

- No Collateral Required: No need for property or any asset as collateral.

- Flexible Tenure: Repayment period ranges from 1 to 4 years.

- Higher Loan Limits: Borrow from PKR 50,000 up to PKR 2 million.

- No Processing Fee on Rejected Applications: If the application is rejected, MCB will not charge any processing fee.

These features make it an ideal option for salaried individuals who want a fast and hassle-free financing option without long-term commitments.

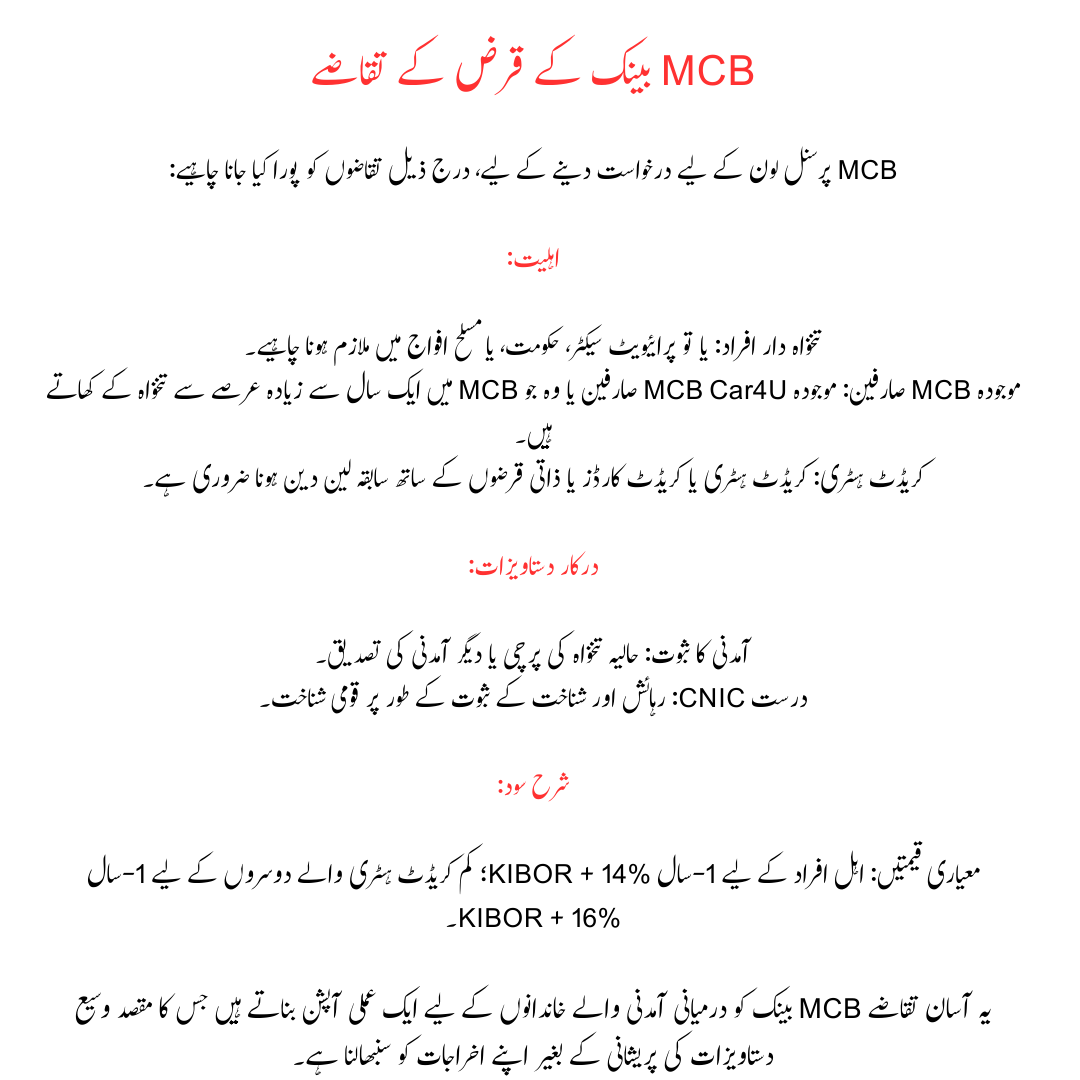

MCB Bank Loan Requirements

To apply for an MCB Personal Loan, the following requirements should be met:

Eligibility:

Salaried Individuals: Must be employed in either the private sector, government, or armed forces.

Existing MCB Customers: Current MCB Car4U customers or those with salary accounts in MCB for over a year.

Credit History: Must have a qualifying credit history or previous dealings with credit cards or personal loans.

Documents Needed:

Proof of Income: Recent salary slip or other income verification.

Valid CNIC: National identification as proof of residency and identity.

Interest Rate:

Standard Rates: 1-Year KIBOR + 14% for qualified individuals; 1-Year KIBOR + 16% for others with less credit history.

These simple requirements make MCB Bank a practical option for middle-income families aiming to handle their expenses without the hassle of extensive documentation.

MCB Personal Loan Interest Rate

The MCB personal loan interest rate varies based on your employment type and credit history:

- Government/Armed Forces Personnel: Enjoy lower interest rates with a base rate of 1-Year KIBOR + 14%.

- Private Sector Employees: Generally charged at 1-Year KIBOR + 16% if they lack a qualifying credit history.

For families looking for financing options with lower interest burdens, Mcb Bank provides interest-free loans in full alignment with Islamic principles.

Also Read : How to Get an Interest-Free MCB Business Loan

MCB Personal Loan Calculator

MCB offers a convenient personal loan calculator to help you estimate your monthly payments before applying for the loan. This tool provides a clear breakdown of:

- Monthly Installments

- Total Payback Amount

- Total Interest Charged

To use the MCB personal loan calculator, simply enter your desired loan amount, tenure, and expected interest rate to get an accurate estimate. If you’d like to try it, click here: MCB Loan Calculator.

How to Apply for an Interest-Free MCB Personal Loan

Applying for an MCB personal loan online is a simple process:

- Visit the MCB Loan Application Portal.

- Fill in your personal and financial details.

- Upload the necessary documents, such as your salary slip and CNIC copy.

- Submit your application for processing.

For the online application portal, click here: Apply Online for MCB Personal Loan. After submission, MCB’s team will review your application, and if all requirements are met, approval usually comes within a few working days.

Frequently Asked Questions (FAQs)

1. What are the main Interest-Free MCB Personal Loan requirements?

The applicant must be a salaried individual, aged between 21-60 years, and have a valid CNIC and proof of income.

2. How can I calculate my loan payments using the MCB personal loan calculator?

Visit the MCB Bank website and access their loan calculator to input your loan amount, tenure, and interest rate to view monthly payments.

3. How do I apply for an Interest-Free MCB Personal Loan online?

Fill out the online application form on MCB’s official portal, upload the necessary documents, and submit for review.

4. What is the MCB personal loan interest rate?

It ranges from 1-Year KIBOR + 14% for government and armed forces employees to 1-Year KIBOR + 16% for others.

5. Is there an interest-free loan option?

Yes, Mcb Bank offers interest-free loans based on Islamic financing principles.

6. Is collateral required for an MCB personal loan?

No, MCB personal loans are collateral-free.

7. How long does it take to get loan approval from MCB?

Typically, it takes a few working days if all documents are complete and eligibility requirements are met.

8. What happens if my loan application is rejected?

No processing fee is charged if your loan application is not approved.

9. What loan tenure options does MCB provide?

Loan tenures range from 1 to 4 years, allowing flexible repayment.

10. Can I apply for an MCB loan from anywhere in Pakistan?

MCB personal loans are available in most major cities, including Karachi, Lahore, Islamabad, and more.

Conclusion

For Pakistani families, MCB Personal Loans offer an ideal solution for meeting financial needs, whether for healthcare, education, or personal emergencies. With the flexibility of the MCB personal loan calculator and the option to apply online, MCB makes personal financing convenient and accessible. Plus, for those preferring an interest-free loan, Mcb Bank’s Islamic financing provides a viable, Sharia-compliant alternative. For more details, MCB’s customer support can be reached at 111-000-622, and additional questions can be addressed at 042-35987979 for the Consumer Helpdesk.

Now, you can confidently navigate your personal loan options to make the best financial decision for your family’s needs.