Mcb bank student loan apply online

In Pakistan, many students dream of pursuing higher education at top universities or even abroad. However, the financial burden of paying for tuition and other expenses often becomes a significant hurdle. For families from medical-class or middle-class backgrounds, this challenge can feel overwhelming. That’s why many students are searching for terms like “MCB Bank student loan” and “MCB Bank student loan apply online” to find a way to fund their education and secure their future.

MCB Bank offers a great solution for students facing financial difficulties. Their student loan programs are designed to help Pakistani students continue their education without worrying about tuition fees. Whether you’re aiming to study at a local university or pursue education abroad, MCB’s student loans can help you achieve your academic goals.

In this article, we’ll cover everything you need to know about MCB Bank student loans, how to apply online, and the requirements for students looking for financial assistance. So, let’s dive deep into this topic and explore the opportunity MCB offers.

Also Read : U bank home loan government markup subsidy scheme online

MCB Bank Student Loan Apply Online

MCB Bank’s student loan program provides an opportunity for students to manage their educational expenses easily. With the option to apply online, MCB makes the process more convenient and accessible for everyone. You can now avoid the hassle of going to the bank in person and apply from the comfort of your home.

Steps to Apply for MCB Bank Student Loan Online:

- Visit the official MCB Bank website.

- Navigate to the loan section and select the student loan category.

- Fill out the required forms with your personal and educational information.

- Submit the application online.

If you want to apply online, visit this link: MCB Bank Student Loan Application

The application process is straightforward, ensuring that you can quickly apply without any complex paperwork.

Also Read : Bank AL Habib Car Loan Apply Online Pakistan

MCB Bank Loan Requirements

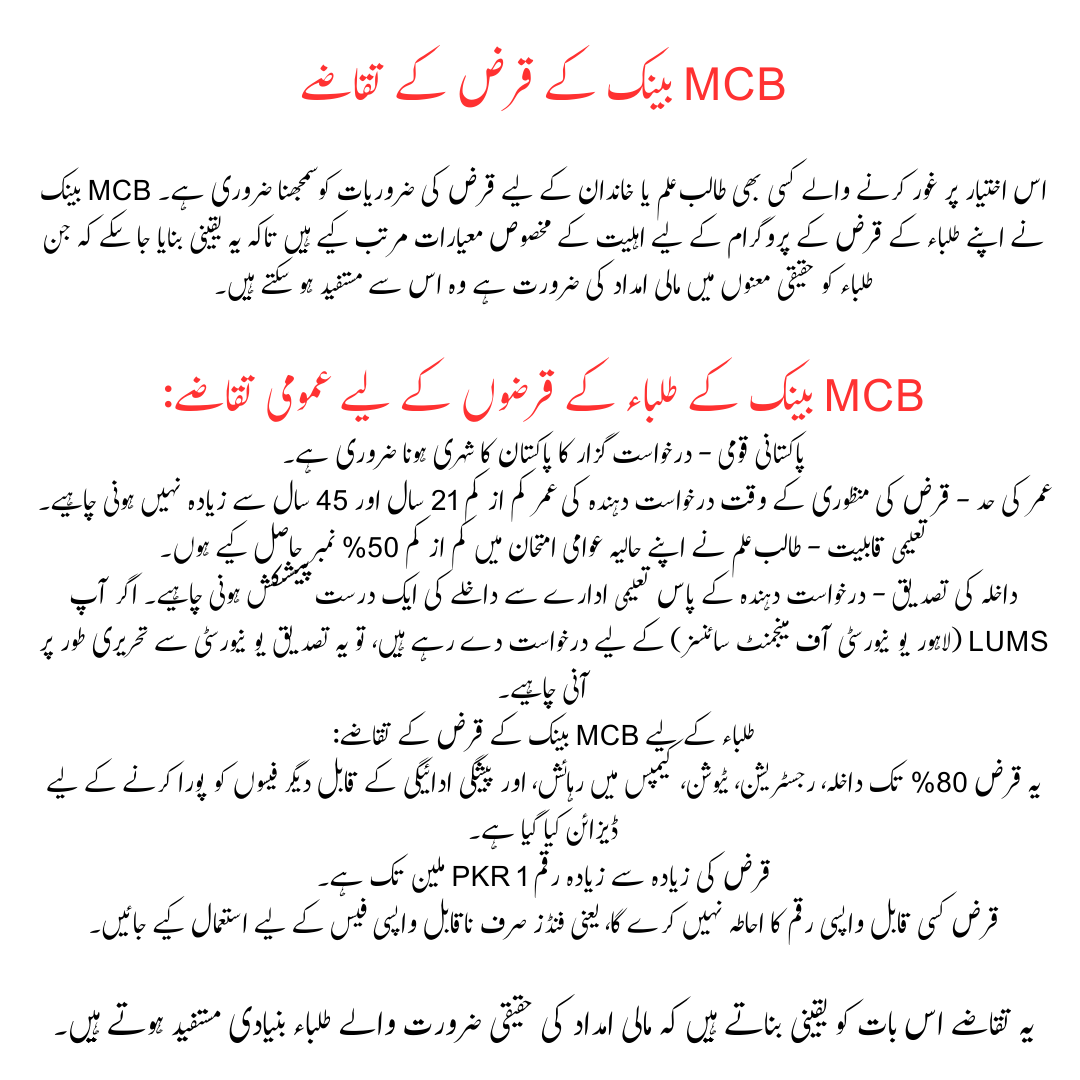

Understanding the loan requirements is essential for any student or family considering this option. MCB Bank has set specific eligibility criteria for its student loan program to ensure that students who truly need financial assistance can benefit from it.

General Requirements for MCB Bank Student Loans:

- Pakistani National – The applicant must be a citizen of Pakistan.

- Age Limit – The applicant should be at least 21 years old and not more than 45 years old at the time of loan approval.

- Educational Qualification – The student must have secured at least 50% marks in their most recent public examination.

- Admission Confirmation – The applicant must have a valid admission offer from the educational institution. If you are applying for LUMS (Lahore University of Management Sciences), this confirmation must come from the university in writing.

MCB Bank Loan Requirements for Students:

- The loan is designed to cover up to 80% of admission, registration, tuition, on-campus residence, and any other fees payable in advance.

- The maximum loan amount is up to PKR 1 million.

- The loan will not cover any refundable amount, meaning the funds should only be used for non-refundable fees.

These requirements ensure that students with a genuine need for financial assistance are the primary beneficiaries.

Loan Tenure and Repayment

MCB Bank’s student loan comes with flexible repayment options. The maximum repayment tenure is seven years, which includes a grace period of six months after graduation. This grace period allows students to find employment and settle into their careers before starting repayment.

Pricing

MCB Bank’s student loans are priced at the 6-month KIBOR rate, making it an affordable option compared to other private loan providers.

Why MCB Bank Student Loan Is the Best Option?

For Pakistani students struggling with financial issues, MCB Bank offers a trustworthy and accessible solution. Here’s why you should consider MCB Bank’s student loan:

- Convenient Online Application: You can easily apply for the loan from anywhere through MCB’s website.

- Flexible Repayment Options: With a seven-year repayment period and a grace period of six months, you get ample time to start your career before repayment.

- Covers Major Expenses: The loan covers up to 80% of the most critical educational expenses, including tuition and accommodation.

- Support for Higher Education: Whether you’re studying in Pakistan or planning to go abroad, MCB Bank’s student loan can help you fulfill your dreams.

Also Read : Faysal Bank Car Loan Apply Online in Pakistan

Frequently Asked Questions (FAQs)

1. Who is eligible for MCB Bank student loans?

Any Pakistani national between the ages of 21 and 45, with valid admission and 50% marks in their last public exam, is eligible.

2. Can I apply for the loan online?

Yes, you can easily apply online through the MCB Bank website. Click here to apply online.

3. What is the maximum loan amount I can apply for?

The maximum loan amount you can apply for is PKR 1 million.

4. How long do I have to repay the loan?

The repayment tenure is up to seven years, including a grace period of six months after completing your education.

5. Can I use this loan for studying abroad?

Yes, the loan can be used for both local and international education.

6. Does the loan cover accommodation expenses?

Yes, it covers up to 80% of on-campus accommodation fees.

7. Is there any grace period before I start repaying the loan?

Yes, MCB offers a grace period of six months after graduation.

8. What is the interest rate on MCB Bank student loans?

The loan is priced at the 6-month KIBOR rate.

9. What documents are needed to apply?

You will need your CNIC, admission letter, and educational transcripts to apply.

10. Is there a maximum age limit to apply for the loan?

Yes, the maximum age for loan approval is 45 years.

Also read : How to Apply for HBL Student Loan

Conclusion

The financial burden of pursuing higher education can be a significant challenge, but MCB Bank student loans offer a practical solution. By applying online, you can quickly access the funds you need to continue your studies, whether locally or internationally. MCB Bank’s flexible repayment options, partnership with LUMS, and support for MBA students make it one of the best choices for students in Pakistan.

So, if you’re a student looking for financial assistance, apply for the MCB Bank student loan online and take a step towards securing your educational future!